There's a lot of buzz going around based on a super-big chart-filled presentation by some scare-mongers called "T2 Partners", who're attempting to use reality to scare customers into buying their services. Sadly, the reality they paint, is, well, real. Here're a few of said charts:

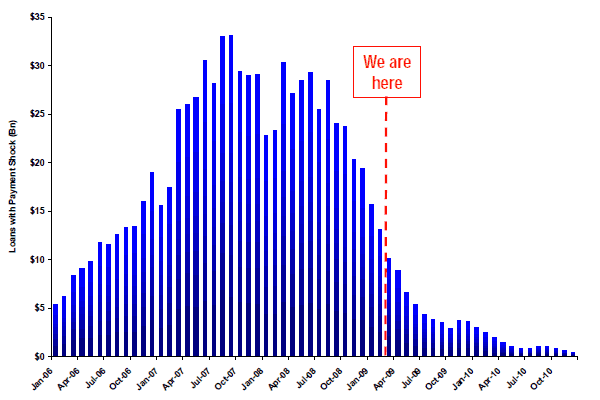

Here's the situation with regards to subprime mortgage rate resets:

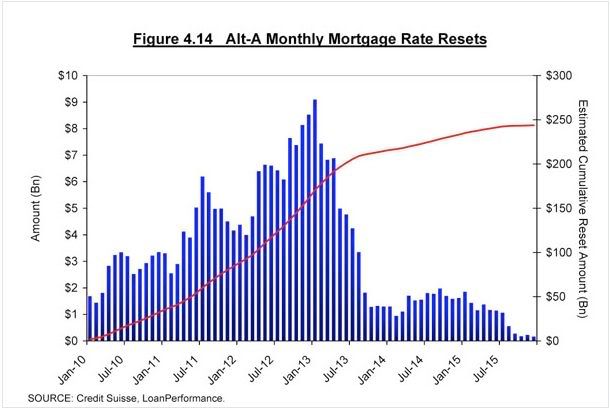

Here's where we stand with regards to the Alt-A resets...

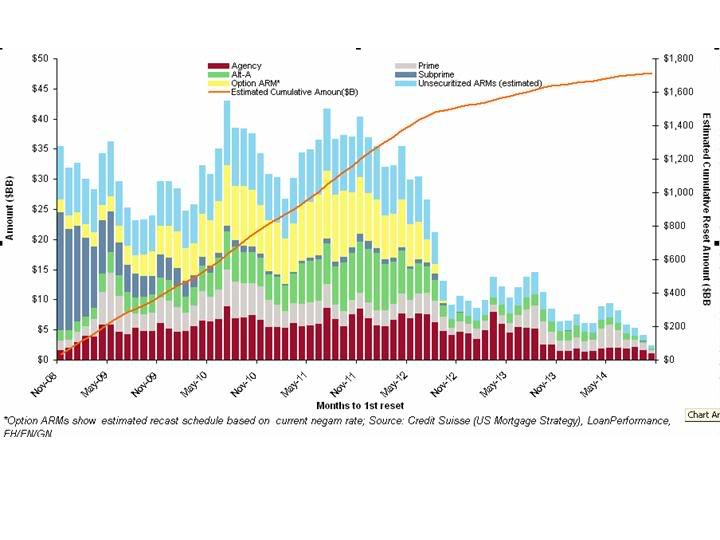

or scheduled resets in general:

The 64-thousand-dollar question of course is what this will do to bank valuations. No-one knows for sure how many of these mortgages will end up defaulting, but I'm suspecting that they're already factored into bank shares' trading prices.

With $1.7T of mortgages resetting over the next five years, during the worst economy seen in decades, the big question will be how will this affect the rest of the economy. Especially retail sales. No-one knows, but I'm wagering that those "V-shaped" recession wonks are wrong, and that the "U-shaped" wonks are also wrong. Given the way mean reversion versus a growth trend-line tends to work, I'm betting on an "L-shaped" recession that stays flat, just like the Japanese have seen (since we're repeating their mistakes).

This of course while we're debasing the currency so much that the Treasury Secretary got laughed off the stage in China.

We now return you to your regular sunshine filled day.