Hi y'all!

Captain Cheerful(TM) here: I've been taking advantage of time off to put a weather eye to economic data (predigested: I'm not a propeller-headed econ-boffin; I read other people's opinions having identified their biases and/or financial interests -- but so far I've been unpleasantly unsurprised, FWIW), and 2010 isn't looking so spiffy.

First, and foremost, here's the first thing everyone needs to know:

THE U.S. IS NOT OUT OF THE "PREVIOUS" RECESSION.

Fine print: the way that the financial stats are calculated, debt-based spending by the federal government counts as economic activity -- when you remove the amount that the Obama administration has run been running up the credit cards to stave off fiscal armageddon (and thankfully so: it has been giving the responsible among us time time to de-leverage our housholds before the shit REALLY hits the fan). The private economy is still collapsing like Eddie Izzard's proverbial "flan in a cupboard".

The second thing that everyone needs to understand is that, in spite of the fact that the economy is being propped up on Uncle Sam's credit-card, everyone else in the whole world either is panicking to issue more debt or is ceasing their overseas investing to focus on their own situation. For examples, check up on Greece or China, respectively. In order for the economy to continue collapsing like a flan in a cupboard (instead of collapsing faster), we need people to buy a ton of t-bonds. There are only a few ways this'll happen:

1) A collapse in the stock market. (This's probably overdue anyway -- folks have been cheering the return to overblown stock prices for a while now and, while I'm not enough of a fool to bet against the stock market directly (the famous saying is "the market can stay irrational longer than you can stay solvent"), my money's where my mouth is here -- what little we have for retirement's all in the sadly dreadful fixed-income market.) This would cause "main street" investors to panic again and flock to Treasuries as a "safe haven" investment. The open question here is whether or not, in such a scenario, that there will be enough extracted from the market "on the way down" to fund 2010's scheduled credit-card binge -- a lot would depend on how fast the market cratered. Let's not hope for this scenario.

2) A return of interest rates worth investing in. Tired of trying to fund your retirement on 1% returns? So are all the retirement fund managers out there who've been forced to borrow money to invest (capitalized by their client's investments) so they can eek a decent return out of the market. They'd love to be able to deleverage their funds without being put out of business when the fund next door shows five times their earnings while keeping its larger risk profile buried. This would get a lot of folks who're tired of waiting for the P/E bomb in equities to go off (P/E ratios have been insane for over a decade now and will get visibly worse with worsening economic conditions) while sitting in cash right now to plunk down for Treasuries and maybe keep armageddon from happening for another year, but the problem is that with so many households on the brink of ruin already, for Bernanke to decide to pull up on the interest-rate lever would be disastrous -- every household with significant floating-interest-rate debt would decrease their spending by the difference needed to pay the extra interest, assuming they don't default to such a huge extent that even the schmucks on Wall Street can't sweep the carnage under the rug. This would be like setting off a fusion bomb in the center of the economy. Lets not hope for this one, either.

3) For Treasury yields to increase. Unlike increasing the "official" interest rate (the "coupon" rate) of treasury bonds, the market could force the effective interest rates of treasuries to explod upwards simply by paying less for each bond at auction. This would be something that Bernanke & Geitner cannot control, but would have similar economic impacts on #2, above. This would also smash the prices of the T-bonds in people's existing portfolios -- and since the existing bonds scheduled interest payments are so miniscule, this would demolish a lot of pension funding. Another for the not-hoped-for bucket.

4) For complete cessation of all non-entitlement social spending and all spending on both Iraq and Afghanistan, effective immediately. This might cut out the need for the bond issuances in the first place (mostly -- Bush's medicare sellout to the grey-panthers will still bite us), but the political and, more importantly, diplomatic bloodletting that we'd suffer would be egregious in the extreme -- the government would lose all credibility both here and abroad. (The folks in Taiwan, for example, would buy a lot of Depends.) This one's not going to happen, nor, frankly should it. But even if it did, I'm not convinced that it'd keep the rate of collapse where it is.

5) Something happens that I'm not smart enough to think of, that either saves our bacon or at least kicks the can down the road so we can have an even greater mess a year from now. This would be great. Anyone feeling both smart and influential?

Personally, I'm rooting for #5.

P.S. If anyone thinks I'm just being a worry-wort here, put on your thinking cap and ponder what it means that, of all companies, Arrow Trucking(! WTBFF !) is going bankrupt. Anyone from a "flyover state", aka "where all the shit we take for granted comes from" will be racing for a malt whiskey right about now. Everyone else'll start to get it in about a week... .

P.P.S. "WTBFF" means "what the bloody flying fuck", an expletive that even potty-mouthed me generally holds in reserve for serious occasions.

Saturday, December 26, 2009

Tuesday, November 17, 2009

A Horror Movie Only Blair Could Have Written

... and here I thought he was in Korea. He must be moonlighting.

Tuesday, November 10, 2009

The King's Singers Deconstructing Bach

(you'll want to turn the sound up, since it's keyed a little low)

Wednesday, October 14, 2009

A much needed breather

Everyone's busy arguing over whether we're going to have a "V" shaped recovery or a "W" shaped recovery (or an "L" shaped recovery). I've no greater clue than anyone else, but regardless of how it falls out, the similarity of our situation to that of Japan in the previous decade augurs for a double-dip at least, before anything long-run-positive occurs. If the boffins are right and we're going to have a rallying economy for the next year or so before the double-dip danger really rears its head, then this presents a much needed breather for households to repair their balance sheets and maybe accrue some savings. A second dip would likely be more violent than the first, as the "true disbelievers" would have all been shaken out by then, so savings cushions will be critical -- I don't know what the macro trend is looking like, but we're doing exactly what the average Japanese consumer did in the '90s: welding our wallets shut. Sure, it was bad for their retail sector and will be awful for ours (with commercial real estate to fall right on it's heels), but with baseline unemployment running 16%, deflation rampant and with equal risks of stag-disinflation and stagflation to follow, who cares?

But I'll take the breather.

But I'll take the breather.

Monday, October 05, 2009

It's Officially Here

That's YoY price changes; deflation is now here even when measured by price (the symptom thereof, not the real thing). It was already here, of course, but now we can expect to see people asking the government to find a way to keep prices from coming down (insanity...)

And in other fun, here's the first negative disposable personal income in 60 years:

(hat tip: the above from Mike Shedlock)

(hat tip: the above from Mike Shedlock)What kind of insanity might we expect people to ask from the government now that the chips are officially down? Price supports? Consumer dept-relief? Michael Moore in the White House (now that he's made all that money going after, to paraphrase Bill Hicks, "that anticapitalism dollar -- that's a great market!")? Whatever it's gonna be, hang onto yer hat and save your pennies, because money's getting more expensive, and that'll make debt even more so.

For more cheerfulness, head to EconomPic's latest labor force graphs.

Wednesday, September 30, 2009

The Fed, Again

The FDIC's reserve balance just went negative -- they're going to charge member banks three month's dues in advance in order to compensate. This's the moral equivalent of the FDIC borrowing from its member banks in order to sustain them.

In other news, nearly half of all treasury bonds purchased at recent auctions (which's how the sales are conducted) were bought not by regular investors or by foreign central banks, but by our own Fed, which, conveniently enough, is purchasing lower-grade paper from other central banks to help fund their continued purchase of treasuries.

Needless to say, I'm a big supporter of the bill to audit the bastards.

In other news, nearly half of all treasury bonds purchased at recent auctions (which's how the sales are conducted) were bought not by regular investors or by foreign central banks, but by our own Fed, which, conveniently enough, is purchasing lower-grade paper from other central banks to help fund their continued purchase of treasuries.

Needless to say, I'm a big supporter of the bill to audit the bastards.

Tuesday, September 15, 2009

Vérinage

Apparently the French have been demolishing buildings 9/11-style (sans aircraft) for quite a long time and consider it a standard demo technique, called "vérinage". The general idea is that the weight of the top portion of the building, even though it can be supported by the building, contains such a massive amount of potential energy that once it's fallen a story or two it can easily sheer through any and all support beneath it.

To my uneducated eye this looks exactly like the World Trade Center's collapse, especially in the three aspects of

While I cannot declare with absolute certainty that the twin towers falling was the work of physics and not a nefarious plot by an evil vice-president and his secret legion of freedom-hating evil-doers, it's good enough for me. :D

To my uneducated eye this looks exactly like the World Trade Center's collapse, especially in the three aspects of

- Massive ejection of dust & debris

- Near free-fall appearance ("near" because if you can eyeball the difference between a 9.8 m/s*s fall and an 9.0 m/s*s fall, you're a better man than I)

- Sheer vertical collapse similar to standard U.S. explosives-based demolition.

While I cannot declare with absolute certainty that the twin towers falling was the work of physics and not a nefarious plot by an evil vice-president and his secret legion of freedom-hating evil-doers, it's good enough for me. :D

"A compilation of demolitions conducted using the French demolition technique of vérinage. This is achieved with hydraulics that push structural members out of alignment, allowing the top portion of a building to then demolish the structure below via gravity alone, without the use of explosives. Note that the collapses are rapid and produce copious dust."

Thursday, August 13, 2009

Energy Storage is EASY

I was astounded by another article I saw this morning talking about the problem of storing energy that photovoltaics, wind-power, etc. all face. The article went on to talk about truly massive (city-sized) electrical batteries, ultracapacitors (which'll be great for cars) and other devices. For small-scale use, the problem remains, but for broad-scale power production where energy is only produced during the day, but the amounts of energy being produced are massive, why hasn't anyone thought of digging a big basement and almost filling it with a massive concrete block? When you need to store power, you lift the block up to ground level, and when you want to draw power, you lower it. If you want your power I/O to be very sharp-edged, you use a simple pulley (or massive rotating beam serving as a pulley); multiple pulleys can be rigged for any level of I/O you want. Now, granted, conversion back and forth from mechanical to electrical energy will have losses, but given the non-linear response to compressing a gas (not to mention keeping a pressurized cavern airtight), friction losses from flywheels, etc., it can't be that bad.

But what really gets me is that no-one's mentioned it before even though potential energy is part of high-school physics -- could it be that hard? Really?

But what really gets me is that no-one's mentioned it before even though potential energy is part of high-school physics -- could it be that hard? Really?

Friday, July 24, 2009

Why California is Doomed

I motion that logic, rhetoric and economics be taught in Junior High School, and that any students receiving less than a C on a standardized test thereof be immediately fed to rabid stoats.

Tuesday, July 21, 2009

Obama Looking Weak

So the full-court press is on to label the Republican opposition to the Rush-to-Health-Care as political obstructionism is on. This is a bad move and an advertisement to anyone watching that the democrats are playing a weak hand. Just like the Bush administration couldn't get any of the democrats to participate in their attempt to reform Socialist Ponzi Administration Security Administration, the Republicans are wisely (per their constituents) dragging their feet on the federal health-care takeover (which may or may not constitute "reform", depending on one's faction of choiceperspective). The Democrats promised up and down to reform the way health-care is provided in this country, and, since they own both the Legislature and the Executive, have no excuse not to pass such a reform. But the thing is, they know it'll suck: until money and stethoscopes grow on trees, such reform will include all manner of rationing, and is liable to have the kinds of customer service made famous by Marge Simpson's twin sisters. If the "reforms" pass by a party-line vote, then the Democrats get all the credit or blame for however it shakes out, and those in power know this'll mean a lot of blame. Such a party-line establishment of nationalized health-care would constitute electoral red-meat for the Republicans, and everyone on the hill knows it.

And Obama & his aides just admitted they don't know what to do about that -- on national TV.

The left-wing will fall in line behind the repudiation of the Republicans for being "political" (OMG, Legislators being political?! How shocking!), and this will work to stave off their constituency temporarily, but in the end they'll either have to gut their program sufficiently that the Repubs can take that home to their 2010 campaigns as a legislative victory, or they'll have to take the larger risk and completely own their health-care program forever-and-ever-amen.

While ex-President Bush could claim that he couldn't line up enough votes to defeat a filibuster (which is the normal way a faction advertises that it hasn't the balls to sign its own checks), President Obama owns his Congress, so if he tarries too long he'll risk being branded a coward, to boot.

If I were a Republican congressman, I might even risk smiling.

And Obama & his aides just admitted they don't know what to do about that -- on national TV.

The left-wing will fall in line behind the repudiation of the Republicans for being "political" (OMG, Legislators being political?! How shocking!), and this will work to stave off their constituency temporarily, but in the end they'll either have to gut their program sufficiently that the Repubs can take that home to their 2010 campaigns as a legislative victory, or they'll have to take the larger risk and completely own their health-care program forever-and-ever-amen.

While ex-President Bush could claim that he couldn't line up enough votes to defeat a filibuster (which is the normal way a faction advertises that it hasn't the balls to sign its own checks), President Obama owns his Congress, so if he tarries too long he'll risk being branded a coward, to boot.

If I were a Republican congressman, I might even risk smiling.

Monday, July 20, 2009

California Politicians Slimier than Ever

So the folks here in dreamland have cooked up a way to fix the $26B budget defecit:

* $16B in cuts, except that six $B of that is really just borrowing from the school budget and must be paid back eventually, to the tune of $11B

* $2B in revenues legally belonging to municipalities diverted to state coffers, also to be repaid with some unspecified level of interest -- This isn't the first; if I were a mayor I wouldn't be holding my breath.

* $4B by accellerating withholdings by 10%, temporarily increased taxes that get paid back later come tax-time. Except: by the time you're getting your refund you've already gotten zapped with the latest withholdings. This's the slimiest it's-not-a-tax tax I've ever heard of.

* $1.5B of robbing Peter to pay Paul (at the state level: the municipal level's already been robbed)

* Moving a payday out from this calendar year into next year so that the state workers lose the float on the money and so the payment doesn't have to be calculated in this year's payouts.

* Other unspecified gimmicks.

So while claiming, to great fanfare, that they've finally fixed the problem, California's politicos have done what they've always done: kicked the can down the road so their mess will be Somebody Else's Problem. You know the old joke that you can tell a politician is lying if his lips are moving? Our currentpandererspoliticians are doing their part to make even the folks in Beijing and Brussels look honest.

* $16B in cuts, except that six $B of that is really just borrowing from the school budget and must be paid back eventually, to the tune of $11B

* $2B in revenues legally belonging to municipalities diverted to state coffers, also to be repaid with some unspecified level of interest -- This isn't the first; if I were a mayor I wouldn't be holding my breath.

* $4B by accellerating withholdings by 10%, temporarily increased taxes that get paid back later come tax-time. Except: by the time you're getting your refund you've already gotten zapped with the latest withholdings. This's the slimiest it's-not-a-tax tax I've ever heard of.

* $1.5B of robbing Peter to pay Paul (at the state level: the municipal level's already been robbed)

* Moving a payday out from this calendar year into next year so that the state workers lose the float on the money and so the payment doesn't have to be calculated in this year's payouts.

* Other unspecified gimmicks.

So while claiming, to great fanfare, that they've finally fixed the problem, California's politicos have done what they've always done: kicked the can down the road so their mess will be Somebody Else's Problem. You know the old joke that you can tell a politician is lying if his lips are moving? Our current

Wednesday, July 15, 2009

Tuesday, July 14, 2009

Nuff Said: The Economist on TX vs CA Economies

Friday, June 19, 2009

The Newest Deal

Obama just announced that they'll allow the government agencies responsible for financing the housing bubble to try to prop that bubble up by allowing refis of up to 125% of the house's "value" (original price?). I can't imagine who'd buy such an instrument from them, but just a word to the wise, don't do it if it tempts you.

Refis are 2nd mortgages and are recourse loans; unlike 1st mortgages, if you default on a refi, they can take the house, then come after you for the rest.

Refis are 2nd mortgages and are recourse loans; unlike 1st mortgages, if you default on a refi, they can take the house, then come after you for the rest.

Tuesday, June 16, 2009

Economics for the Citizen

Just a link post; I'd call Walter Williams my favorite economist, but I don't really have any favorites except for not-Krugman. But anyway, Walter Williams freakin' rocks, and he has small class notes for an intro econ course he teaches called Economics for the Citizen. It's both really good and also nice & short too. I highly recommend it.

Wednesday, June 03, 2009

Getting Ready for the Mortgage Defaults to Get Serious

No doom & gloom for a while, I must be losing my touch.... Here's something just to keep the stomach acids going:

There's a lot of buzz going around based on a super-big chart-filled presentation by some scare-mongers called "T2 Partners", who're attempting to use reality to scare customers into buying their services. Sadly, the reality they paint, is, well, real. Here're a few of said charts:

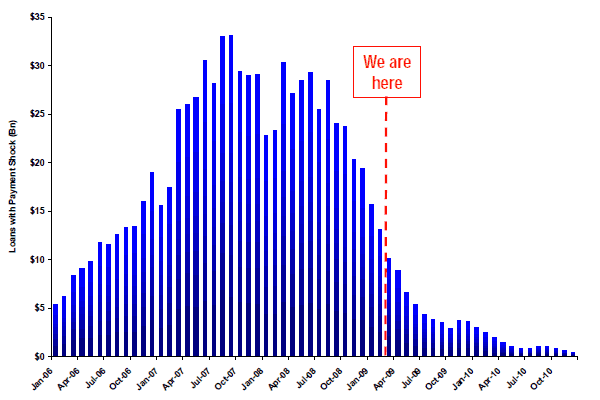

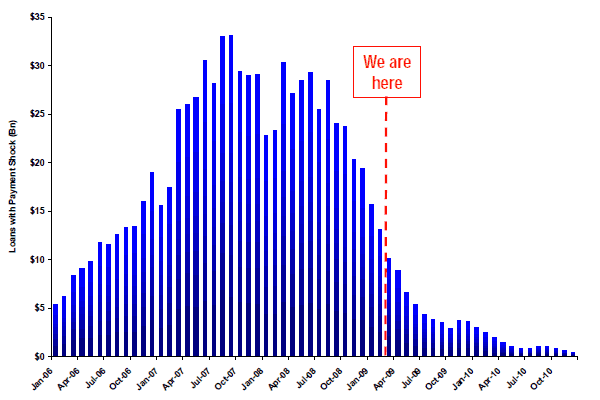

Here's the situation with regards to subprime mortgage rate resets:

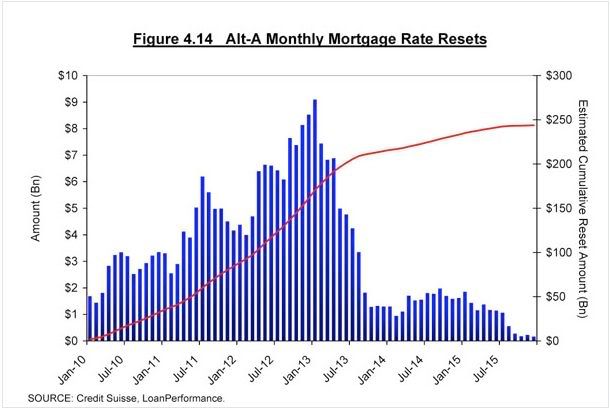

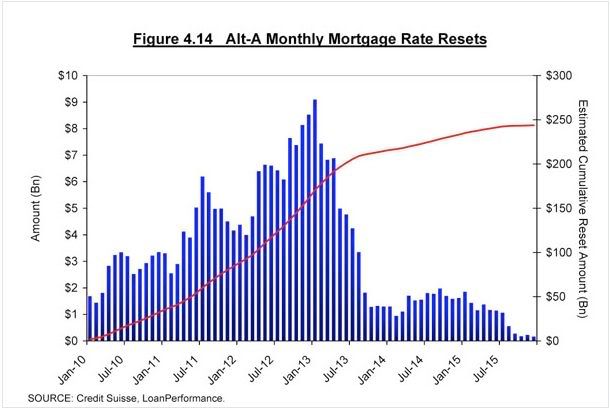

Here's where we stand with regards to the Alt-A resets...

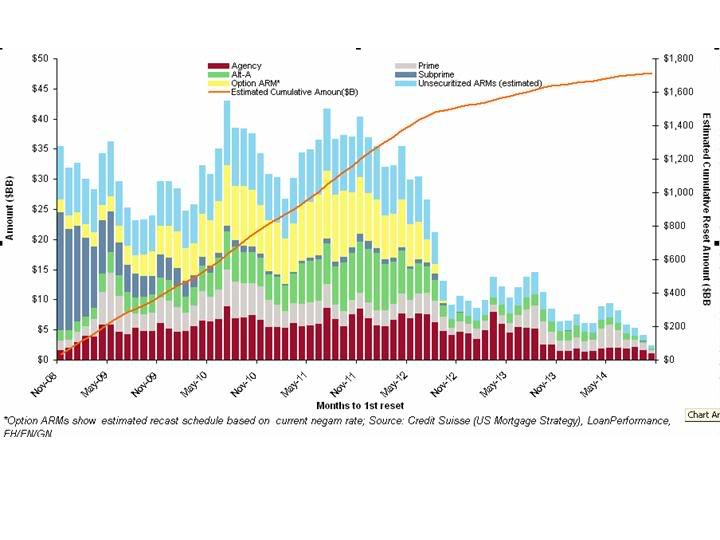

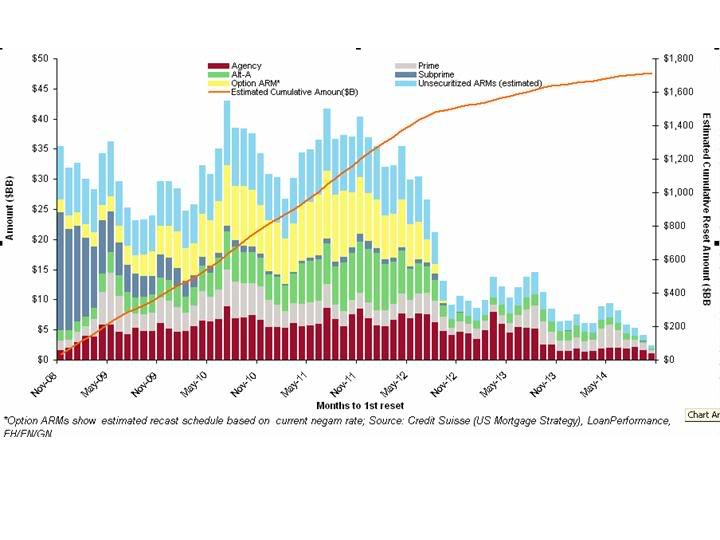

or scheduled resets in general:

The 64-thousand-dollar question of course is what this will do to bank valuations. No-one knows for sure how many of these mortgages will end up defaulting, but I'm suspecting that they're already factored into bank shares' trading prices.

With $1.7T of mortgages resetting over the next five years, during the worst economy seen in decades, the big question will be how will this affect the rest of the economy. Especially retail sales. No-one knows, but I'm wagering that those "V-shaped" recession wonks are wrong, and that the "U-shaped" wonks are also wrong. Given the way mean reversion versus a growth trend-line tends to work, I'm betting on an "L-shaped" recession that stays flat, just like the Japanese have seen (since we're repeating their mistakes).

This of course while we're debasing the currency so much that the Treasury Secretary got laughed off the stage in China.

We now return you to your regular sunshine filled day.

There's a lot of buzz going around based on a super-big chart-filled presentation by some scare-mongers called "T2 Partners", who're attempting to use reality to scare customers into buying their services. Sadly, the reality they paint, is, well, real. Here're a few of said charts:

Here's the situation with regards to subprime mortgage rate resets:

Here's where we stand with regards to the Alt-A resets...

or scheduled resets in general:

The 64-thousand-dollar question of course is what this will do to bank valuations. No-one knows for sure how many of these mortgages will end up defaulting, but I'm suspecting that they're already factored into bank shares' trading prices.

With $1.7T of mortgages resetting over the next five years, during the worst economy seen in decades, the big question will be how will this affect the rest of the economy. Especially retail sales. No-one knows, but I'm wagering that those "V-shaped" recession wonks are wrong, and that the "U-shaped" wonks are also wrong. Given the way mean reversion versus a growth trend-line tends to work, I'm betting on an "L-shaped" recession that stays flat, just like the Japanese have seen (since we're repeating their mistakes).

This of course while we're debasing the currency so much that the Treasury Secretary got laughed off the stage in China.

We now return you to your regular sunshine filled day.

Wednesday, May 20, 2009

Progress in California

They just had an election yesterday on whether a convoluted scheme to change nothing and instead kick the proverbial can even farther into the future; it failed, hard.

And today they're announcing an 18% pay cut for elected officials.

It's not much, but it's a start. It'll be a long, long time before California will live within its budget, but it's a start.

And today they're announcing an 18% pay cut for elected officials.

It's not much, but it's a start. It'll be a long, long time before California will live within its budget, but it's a start.

Wednesday, May 13, 2009

Obama versus the Constitution

Eric Holder was interviewed today and explained that they're looking for a new SCOTUS appointee who "understands that the constitution is a living document that [must handle situations the founders never anticipated]". The "living document" buzz-phrase is code for "we only want to honor the constitution where it's convenient, but elsewhere will interpret it as we choose."

The more that this kind of crap is tolerated the less our rule of law is worth.

The more that this kind of crap is tolerated the less our rule of law is worth.

Saturday, May 09, 2009

Concord Juice

Maddie bought me some pure Concord grape juice; not the crappy filler-eque juice used by leftover european grapes, but honest-to-Gort east-coast grapes that just taste purple.

I forsee wine-making experiments....

I forsee wine-making experiments....

Monday, April 13, 2009

MOUSs

Tonight I got home after an unpleasant commute, had a pleasant supper, then went out and dealt with the rat that had wandered into our garage and met the fate of all small peanut-butter-attracted creatures. Mr. Rat had lived a full life, and had grown to quite a respectable size, but in spite of his lingering moisture, when I came across him he'd lost quite a bit of his former stature; he was just at that sweet spot of putrefacation that smells thick, smokey and almost sweet, and I would have swept him immediately into a sack, but he was defended by MOUSs.

I'd never experienced Maggots of Unusual Size before; the ones I've seen before topped out at about a centimeter, but these guys were the breadth of a quarter, WITH FEET. I haven't seen anything sucking away at a corpse like that since a month ago when the UAW rep from Chrysler was interviewed, it was that disgusting....

According to Maddie, I've now earned my Hubby Points(tm) for the remainder of the year.

I'd never experienced Maggots of Unusual Size before; the ones I've seen before topped out at about a centimeter, but these guys were the breadth of a quarter, WITH FEET. I haven't seen anything sucking away at a corpse like that since a month ago when the UAW rep from Chrysler was interviewed, it was that disgusting....

According to Maddie, I've now earned my Hubby Points(tm) for the remainder of the year.

Friday, April 10, 2009

Obama's Socialized Mortgage Program

The Fed is now buying Fannie & Freddie mortgages like it's going out of style so that the yields on the notes goes down (remember the inverse price/yield relationships of bonds) and the marketplace gets good mortgage refinance rates, currently in the 4.x range. If your mortgage is held by Fannie or Freddie and you want to refi, go ahead; we're borrowing it from the Chinese....

Details at Making Home Affordable.

Details at Making Home Affordable.

Wednesday, April 08, 2009

Monday, March 30, 2009

The Geitner Plan

And the Left thought that Bush was vile. This scenario this guy lays out is so likely as to be unstoppable. And it would explain why the supposedly brilliant Geithner is acting so tongue-tied: he can't really talk about the fact that his plan is a complete bail-out not just of wall-street's corporations, but of its investors too. The only up-side is that many of those investors are pension funds. Mixed-feelings ahoy....

Oh, and when he says "The Fed", don't forget that he's not talking about the Treasury -- he's referring to the FDIC! These fuckers (Obama & co.) are going to save Wall Street's investors by wiping out the fund that's supposed to secure the bank accounts of every Mom & Pop in the USA (I say "supposed to" because reserves are effectively less than 1% of liabilities).

PS. If you want to see the plan fixed, edit the word "non-recourse loan" from it and make the money from the FDIC get repaid. Then you'll see all those eager participants run to the hills immediately, because that leverage simply will not be repaid. As it is, the "responsible" plan is just like taking out a loan from the bank to buy stocks with, with the only collateral the bank gets being the stock itself -- who wouldn't jump for that deal?

Oh, and when he says "The Fed", don't forget that he's not talking about the Treasury -- he's referring to the FDIC! These fuckers (Obama & co.) are going to save Wall Street's investors by wiping out the fund that's supposed to secure the bank accounts of every Mom & Pop in the USA (I say "supposed to" because reserves are effectively less than 1% of liabilities).

PS. If you want to see the plan fixed, edit the word "non-recourse loan" from it and make the money from the FDIC get repaid. Then you'll see all those eager participants run to the hills immediately, because that leverage simply will not be repaid. As it is, the "responsible" plan is just like taking out a loan from the bank to buy stocks with, with the only collateral the bank gets being the stock itself -- who wouldn't jump for that deal?

Saturday, March 21, 2009

Fun, not fun and whew

In the "and now for something completely different" vein, I just wanted to remark on how much great fun it is to whallop a brick outdoor grilling installation with a 16 lb sledge. It'd be doubly fun if I had any muscles so I didn't have to use so much body english, but still, whalloping fun. What's not so fun is dropping a cubic foot of masonry on your foot. Luckily, I was wearing my special mail-order shoes with the steel toes and met-guards, so instead of the furiously throbbing but otherwise normal looking foot I've got now, I might've had something outta The Tom & Jerry Show.

ouch, but yay ouch. (c:

PS. In other news, Maddie made macaroons and the cats are all over them. I know Photon eats stuff like garlic hummus that he's not supposed to like but both cats eating coconut? Weird.

ouch, but yay ouch. (c:

PS. In other news, Maddie made macaroons and the cats are all over them. I know Photon eats stuff like garlic hummus that he's not supposed to like but both cats eating coconut? Weird.

Thursday, March 05, 2009

Monday, February 23, 2009

Rising Up and Rising Down

I just found out ( by finding it in a store -- say what you like about San Francisco(and I'll probably agree with you, sadly), but it has some great bookstores ) that William Vollmann's 3,500 page magnum opus on violence, Rising Up and Rising Down, has been published in an (affordable) abridgment. This guy was a war correspondent in Syria, Yugoslavia and chunks of Africa, and after witnessing quite a lot of it, decided to sit down for 23 years to write an entire treatise on the subject, including a moral calculus thereof.

Needless to say, I bought a copy. This's very exciting.

Needless to say, I bought a copy. This's very exciting.

Saturday, February 14, 2009

Tuesday, February 03, 2009

FDIC in trouble?

Excerpted from Reuters:

Yuck.

In the meanwhile, I suppose the FDIC is probably better than the alternatives, what with multiple states using accelerated 'abandonment' judgments to confiscate safe-deposit boxes for sale at auction and all.

WASHINGTON (Reuters) - The Federal Deposit Insurance Corp is seeking to more than triple its credit line with the U.S. Treasury Department to $100 billion, a move to give it more financial power to handle U.S. bank failures, the agency said on Monday. The FDIC and Congress are working to boost the agency's current $30 billion borrowing power in legislation being crafted by U.S. Rep. Barney Frank, chairman of the House Financial Services Committee. The move comes as the FDIC's deposit insurance fund has shrunk due to a significant uptick in bank failures over the past year. The insurance fund's value dropped 24 percent in the 2008 third quarter to $34.6 billion. "We would maintain that it's prudent planning to have contingency plans in place," said FDIC spokesman Andrew Gray. The House bill being prepared by Frank would also make permanent Congress's October decision to temporarily increase deposit insurance to $250,000 per customer account. The increase was hurriedly adopted as a temporary way to increase confidence in the struggling U.S. banking system. Frank said the FDIC's desire to increase its borrowing power is a safeguard to ensure the agency can quickly pay out insured deposits when a bank fails and the FDIC is named as a receiver. "They have no immediate need for it, but they just want to make sure they're not constrained in the decision by a lack of the insurance fund," Frank told reporters after meeting Treasury Secretary Timothy Geithner on Monday. "They don't want to say, 'We have to keep this bank open longer than it should because we don't have enough money.'"Is anyone still falling for the "we don't think we'll actually need anything like this, but we'd like you to authorize it really quickly just in case" ploy anymore? The FDIC, IIRC, has been funded to the tune of 1/3 of 1% -- if they actually have to backstop money-center banks' deposits, the debt picture for the country will be even worse than it is already. That is, of course, still assuming that the money could be raised; so far that's held true, but if things keep worsening we may have to revisit the assumption of unlimited federal funding.

Yuck.

In the meanwhile, I suppose the FDIC is probably better than the alternatives, what with multiple states using accelerated 'abandonment' judgments to confiscate safe-deposit boxes for sale at auction and all.

Sunday, February 01, 2009

Money As Debt

Someone uploaded this oldie-but-goodie onto Google as flash-video; it's very worth watching if you want to understand the nature of money.

Saturday, January 31, 2009

Criminals for Gun Control

Courtesy of Mr. Darwin Slaughter, our real estate agent from Texas, an issue for our times....

Friday, January 23, 2009

Nuff Said on Bank "Hoarding"

These are lifted from Mish, and explain why banks aren't lending to the folks clamoring so loudly for more credit...

The problem isn't a credit crisis, it's a solvency crisis. Banks would be insane to continue their profligate lending to people who're already as indebted as the average US'ian. And for those who want the state to step in and rescue people from the results of our collective fiscal insanity (and who clearly haven't read Hayek), don't forget that the tax revenues that people what increased to bail people out have to come from the same people who're feeling the debt squeeze to begin with.

Expect more calls for folks "hoarding" money in their savings accounts to invest like good littlerubescitizens. In the meanwhile, the only way out of this mess will be massive reductions in consumption that will be necessary to accumulate the savings needed to pay back all that debt, with the side-effect of demolishing a large chunk of the consumer-oriented industries and their suppliers.

At least most of you don't live in the land of Wimpy (California, that is, who's voters think "I'll gladly pay you Tuesday for a hamburger today" is sound fiscal policy. Ugh.), and won't have to watch your state hand out dubious IOUs instead of wages & tax returns.

The problem isn't a credit crisis, it's a solvency crisis. Banks would be insane to continue their profligate lending to people who're already as indebted as the average US'ian. And for those who want the state to step in and rescue people from the results of our collective fiscal insanity (and who clearly haven't read Hayek), don't forget that the tax revenues that people what increased to bail people out have to come from the same people who're feeling the debt squeeze to begin with.

Expect more calls for folks "hoarding" money in their savings accounts to invest like good little

At least most of you don't live in the land of Wimpy (California, that is, who's voters think "I'll gladly pay you Tuesday for a hamburger today" is sound fiscal policy. Ugh.), and won't have to watch your state hand out dubious IOUs instead of wages & tax returns.

Monday, January 19, 2009

Alice

Well, a kitten got us this weekend; her name is Alice, and she had a policy of "when in doubt, purr." Expect more soon on Foggy Foot Annex.

And, I seem to have a Tom Lehrer song stuck in my head....

And, I seem to have a Tom Lehrer song stuck in my head....

Tuesday, January 13, 2009

Obama's First Triumphs

Today I had the sorrowprivilege of listening to the beginning of Hillary Clinton's confirmation hearings in the senate while commuting to work. The introductory fellatio was off the Richter scale even for those occasions when the partisanship of the house and legislature match, and the bipartisan olive-branches that really mean "we expect the other guys to lay aside their concerns and priorities so they can advance our agenda instead" were strewn about in that simulation of camaraderie so well known in Minnesota and the deep South.

What I wasn't expecting was in Clinton’s prepared remarks. Sure, she has a tin ear and she delivers speeches exactly the way her husband doesn’t, emphasizing the parts of the sentence that are intended as lubricant while gliding along the portions that should be emphasized, but, while her public speaking continues to startle and surprise the unwary ear, after suffering through her primary campaign’s stump speeches this is hardly astonishing. What was astonishing was the immense amount of slight-of-mind in the speech – she alluded to nearly known opportunity and vexation that the world faces today, but every time she veered dangerously close to making a prescription she slipped sideways into the sort of generalities and pabulum that any fourteen-year-old girl in front of her civics class might have advocated when required to give a political speech. And it really was an assigned but otherwise meaningless speech, as CSPAN long ago converted public hearings into the toilet politicians use to communicate with their masses. The masses this time around are from the Left, who have a “don’t bother me with the details – I trust your good intentions” mind-set, so this was all spot on for the audience at hand. Meanwhile I’m was trying not to run off the road because of how violently my gorge kept rising….

But then it hit me: what a stroke of genius on Obama’s part. After the Clinton machine insisted on torturing all thinking listeners for over a year, Obama has managed to give us at least four years peace, in which Clinton can take her crash-course in rhetoric overseas. To paraphrase General Patton, “our job is not to have Clinton melt our minds melted like cheap Velveeta, our job is to let Clinton melt the other poor dumb bastards minds like cheap Velveeta!”. For four years at least, the only speeches we’ll hear from Clinton will be in quick sound-bytes on CNN. If nothing else, this is truly a triumph of the Obama regime.

But then I thought: “Wait a minute! To confidently speak at length in tones of grand significance while actually saying nothing – isn’t this truly the heart and soul of diplomacy?” In addition to saving our poor scalded minds from her speeches, Obama may have achieved an even grander triumph even before being sworn into office: he may have figured out something Hillary Clinton’s good for!

What I wasn't expecting was in Clinton’s prepared remarks. Sure, she has a tin ear and she delivers speeches exactly the way her husband doesn’t, emphasizing the parts of the sentence that are intended as lubricant while gliding along the portions that should be emphasized, but, while her public speaking continues to startle and surprise the unwary ear, after suffering through her primary campaign’s stump speeches this is hardly astonishing. What was astonishing was the immense amount of slight-of-mind in the speech – she alluded to nearly known opportunity and vexation that the world faces today, but every time she veered dangerously close to making a prescription she slipped sideways into the sort of generalities and pabulum that any fourteen-year-old girl in front of her civics class might have advocated when required to give a political speech. And it really was an assigned but otherwise meaningless speech, as CSPAN long ago converted public hearings into the toilet politicians use to communicate with their masses. The masses this time around are from the Left, who have a “don’t bother me with the details – I trust your good intentions” mind-set, so this was all spot on for the audience at hand. Meanwhile I’m was trying not to run off the road because of how violently my gorge kept rising….

But then it hit me: what a stroke of genius on Obama’s part. After the Clinton machine insisted on torturing all thinking listeners for over a year, Obama has managed to give us at least four years peace, in which Clinton can take her crash-course in rhetoric overseas. To paraphrase General Patton, “our job is not to have Clinton melt our minds melted like cheap Velveeta, our job is to let Clinton melt the other poor dumb bastards minds like cheap Velveeta!”. For four years at least, the only speeches we’ll hear from Clinton will be in quick sound-bytes on CNN. If nothing else, this is truly a triumph of the Obama regime.

But then I thought: “Wait a minute! To confidently speak at length in tones of grand significance while actually saying nothing – isn’t this truly the heart and soul of diplomacy?” In addition to saving our poor scalded minds from her speeches, Obama may have achieved an even grander triumph even before being sworn into office: he may have figured out something Hillary Clinton’s good for!

Friday, January 09, 2009

Un-Cute Un-Relief

Just in case anyone's feeling cheerful, here's an interview with one of the guys that predicted all this financial mess YEARS ago. I don't think it's necessarily as bad as he makes it out to be, but can't disagree any more strongly than that.

Thursday, January 08, 2009

Cute Relief

Subscribe to:

Posts (Atom)

Blog Archive

- ▼ 2009 (35)