Assuming that you don't live in an alternate reality where all wishes are fulfilled, everyone's dreams come true, and unified school districts are Disneyland for the Mind, or, assuming you're not a politician and on the hook to promise such things for fear of other

professional panderers politicians selling their "it's so good it MUST be true!" slogans, the economic affects of price controls are well understood by anyone who got a B or higher grade in Econ-101.

Artificial price ceilings demolish businesses profits and (since business's aren't in the charity field) supply gets rarer and rarer until goods can only be purchased on the black market for thousands of times their real economic worth.

Artificial price floors reduce demand and force consumers to find alternative products that they can afford while suppliers clamor for consumers to buy goods consumers can't afford. This also drives suppliers out of business, forcing them to turn to other markets where their goods are desired.

When inflation rears its ugly head, price ceilings bite and price floors are largely moot. Since it takes time for any periodic inflation to permeate an economy, not everyone benefits immediately from the absence of price floors -- in fact, it seems that the poorest of the community generally don't get the benefit, because by the time their wages have normalized, so has the given run of inflation. But at least the floor hasn't bitten them.

When deflation

1 rears its ugly head, price ceilings are moot and price floors bite. The least well-off in a community feel the hit -- for this reason, almost all price floors and conspiracies to put a floor on pricing, are illegal. This is one of those areas where the political consequences are such that price-fixing laws are actually enforced, unlike other statutes for things like, oh, accepting gifts.

But the politicians that be always exempt one item from the "normal" consideration of economic consequences: wages. People always and everywhere say "inflation is bad!", unless it's wage inflation -- if the schmoe collecting carts at the local Wynn-Dixie gets an extra nickel every hour to produce the exact same economic benefit, then since that's a benefit for a

WorkerTM, then since every adult worker is by definition a

Registered VoterTM, then, this is seen as economic progress regardless of the fact that this drives down the corporate profits that comprise most of our tax base. During periods of inflation wage-inflation is never taken to be a bad thing by anyone who matters, aka: voters.

Well, almost....

It does matter to voters who work for auto manufacturers, because customers have the option to buy cars from companies that don't have union-controlled wage-inflation. Just like the supplier of goods mentioned above, the supplier of labor to, say, General Motors finds that GM would rather buy more robots than pay an ever increasing cost for the same labor. The unions, who derive their money not from serving their people, but from

garnishing their wages collecting dues (which in some states workers must pay regardless of whether they want such "representation"), claim that the answer is to force all suppliers to use union-controlled labor (aka "we want a piece of their wages too!"), thus "evening the playing field". Since we're not yet

2 a police-state, this "unfair" labor can still be purchased by Toyota, who's creaming GM and other

union-infested pro-union producers.

But that's inflation. And right now, despite the increasing costs of materials

3, the state of our money supply looks like it's finally left the super-inflation that it's been in

4. Our real danger right now is coming from the collapse of our money supply (slowed down by the Bear-Stearns buyout); credit-lines, which are ubiquitous under inflationary regimes, are being curtailed left & right as more and more financial institutions are being shown to be "less than fully capitalized"

5The supply of money is shrinking, and, with it, people's desire to purchase goods at last-year's prices. This means producers of goods have to produce goods more cheaply than before if they're going to stay in business. There are three time-honored ways to do this:

- Eat the losses -- this is ruled out by the dwindling supply of credit.

- Use cheaper/fewer materials -- this is ruled out by increasing material costs (even fewer materials still cost more when tallied up).

- Use cheaper labor -- they've been doing this for years already by going overseas.

In the domestic market, some producers like airlines have opted for #3 by reducing the pay of stewardesses and pilots (with unions being forced to participate by the bankruptcy courts) -- but these business use relatively small amounts of relatively high-cost labor, so they

can cut wages. For those producers who use large amounts of unskilled or semi-skilled labor (the schmoe at the Winn-Dixie), their price of labor is set by the government, so their only alternative is to reduce the number of employees on their payrolls. Or, if they're lucky, they can try to get away with not hiring replacement workers when vacancies come up. Or, if their staff are mostly part-time, they can try to reduce the number of hours per employee.

In this scenario, rather than everyone staying employed but feeling the pain as the market worsens, people who want non-dead-end jobs (aka full-time ones), rather than being able to accept a job for less than last year's wage, are simply shut out of the labor market with nowhere to go. And they can thank their local

panderer politician for that.

1 The Fed acts like deflation is worse than inflation, and would say "it's uglier head", but this is because they see things from a control perspective, and, while they can inhibit demand via the price of money, they have no tools that can create demand in a deflation -- lowering the cost of money under such circumstances is like "pushing on a string". For an example, look at Japan's negative (inflation-effective) interest rates.2...

but it looks like medical treatment is heading that way fast, so that the same government that gives us quality control akin to the Post Office's one-week "overnight" delivery and the customer-service the Department of Motor Vehicles is renowned for can be in charge of every medical transaction in the country, under pain of prosecution.

3 With much of the rest of the world finally moving out of poverty this will only continue. I don't have India's numbers, but China has moved 300 million people out of poverty (the equivalent of the entire US population, and is doing its damnedest to bring the its other 1000 million out of poverty too. All these people are our price-competitors for every raw material from cement to oil, and their ability to pay is increasing.4 Don't believe the Fed's numbers on inflation; just instead ask yourself: do you remember when a Ferrari cost $17,000? I don't, but Bill Cosby does!5 If even Fanny-Mae has only $80B capitalizing $5.2T (that's less than 2% reserves folks!), what do you think the now-embarrassed Wachovia and others will look like once their off-balance-sheet items are brought into the sunshine?

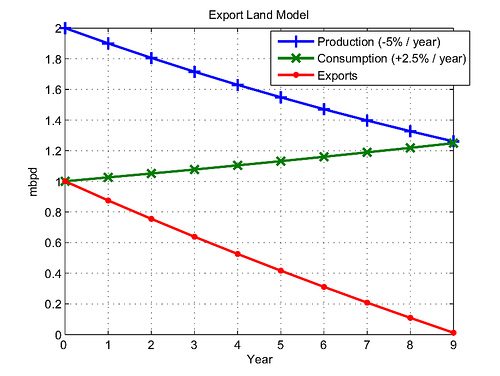

As you can see from the picture, what we're currently doing is exacerbating the symptoms of the current problem, as opposed to what they did last time, which was to look at the symptoms and say "Whoa -- we've gotta put a break on this!"

As you can see from the picture, what we're currently doing is exacerbating the symptoms of the current problem, as opposed to what they did last time, which was to look at the symptoms and say "Whoa -- we've gotta put a break on this!"